Here at Direct Choice, we’re capitalizing on a new wave of marketing opportunities for our health insurance clients brought on by the American Rescue Plan (ARP). That’s the self-aggrandizing title for what you may more readily recognize as the most recent COVID-19 stimulus/relief package. Signed into law on March 11, 2021, Biden’s $1.2 trillion package includes direct stimulus payments, extended unemployment benefits, expanded child tax credits and other safety nets for struggling Americans.

One of the less publicized aspects of the plan includes a big win for people without employer-provided health insurance, including middle-income folks. Here’s a breakdown of how the new law is expanding access to affordable health insurance for Americans in 2021 and 2022:

Larger premium tax credits

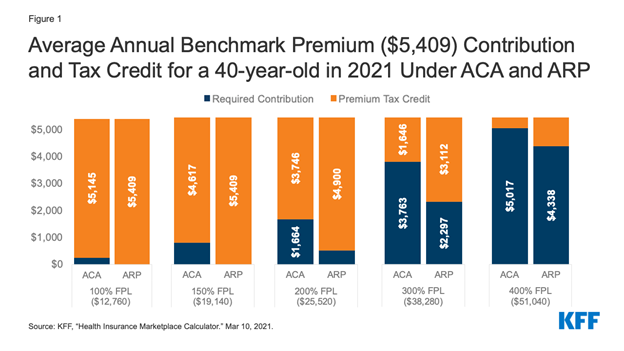

According to HHS.gov, monthly premiums will decrease by an average of $50 per person after credits. Four out of five enrollees (up from 69% pre-ARP) will be able to find a plan for $10 or less and over 1.7 million will pay $0 a month. The chart below from KFF.org provides an example of ARP’s impact on tax credit amounts at every income level.

Expanded access to premium tax credits

The ARP raises the cap on eligibility for people with annual incomes above 400% of federal poverty levels and limits premiums paid by families to no more than 8.5 percent of household income. It also opens the door to temporary COBRA premium subsidies for up to 6 months during 2021 to help many people separated from their employer coverage.

As a result, HHS estimates that an additional 14.9 million uninsured people would be eligible for federal assistance if they choose to enroll in coverage, including 3.6 million uninsured Americans who are newly eligible for subsidies/tax credits.

Extended Special Enrollment Period

The federal government extended the enrollment period for marketplace plans to August 15th hoping that more uninsured people will take advantage of added savings.

All of this is good news for the public and for health insurance companies eager to add more members for 2021 and 2022. Before ARP passed, the government had already extended the Special Enrollment Period prompting more that 200,000 people to enroll through healthcare.gov. Now that marketers are getting the word out about lower costs and extended enrollment in marketplace plans, the potential for a massive wave of new enrollments this summer is very real (again, 3.6 million people are now newly eligible for subsidies/tax credits). We’ll be sure to keep you updated on the impact of ARP for the health insurance market.